Albert Edwards, a prominent market strategist known for his bearish outlook and previous predictions regarding the dot-com bubble, has issued a warning that the stock market may be on the verge of a significant pullback reminiscent of the 1987 crash. His remarks, made in a recent client note, highlight concerns over high valuations and decreasing liquidity, suggesting that a downturn in equities could occur even in the absence of a recession.

As investor sentiment has improved and recession fears have eased, confidence in the stock market has surged. However, Edwards cautions that historically elevated stock valuations do not require an economic downturn to lead to a market decline. He notes that the recent market rally could be primed for a reversal, irrespective of economic conditions.

The basis of Edwards' argument centers on the following key points:

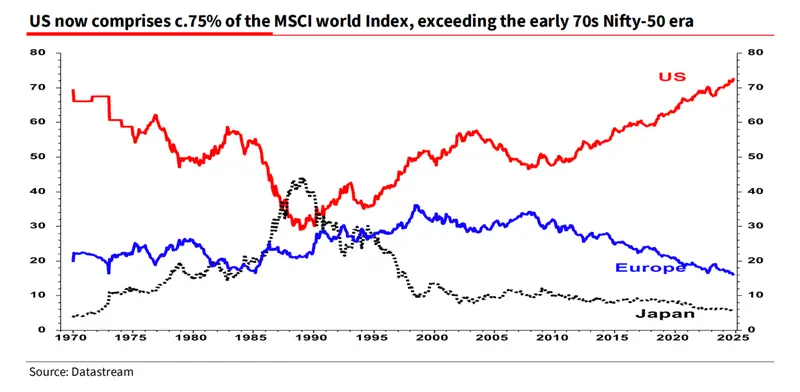

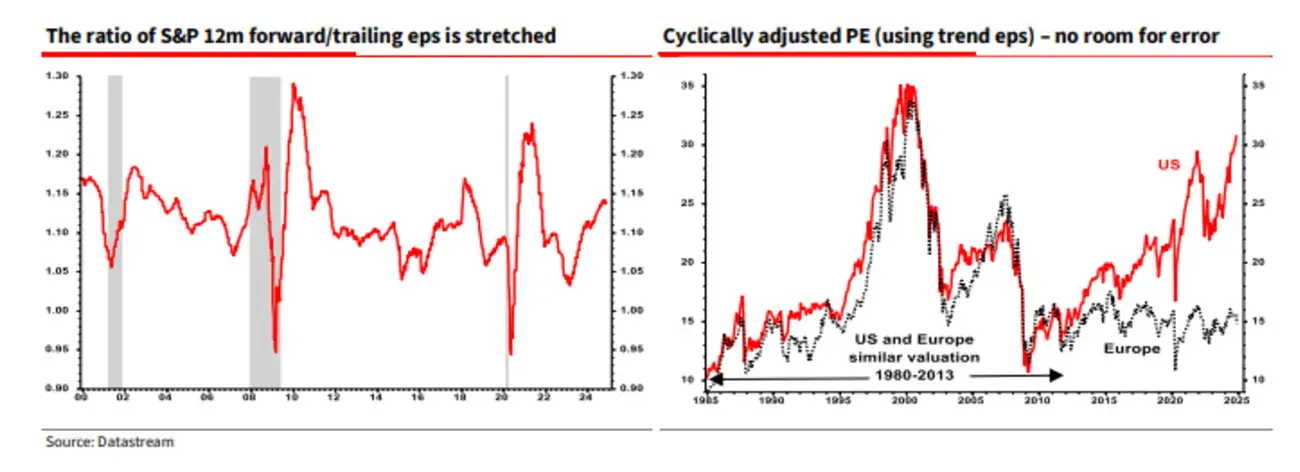

- High Valuations: Edwards emphasizes that U.S. stocks now represent a substantial portion of the MSCI World Index, reaching three-quarters of its total. He highlights various metrics, including the S&P 500's forward price-to-earnings (PE) ratio, which indicates that investor optimism may be outpacing reality. The Shiller CAPE ratio, a widely recognized measure of market valuation, also suggests that current prices are comparable to those seen at the peaks of previous market bubbles.

- Shrinking Liquidity: The strategist points to the Federal Reserve's efforts to reduce its balance sheet, which could exacerbate the situation by tightening liquidity in the market. A declining Global Liquidity Index—an indicator of available market liquidity—further supports Edwards' concerns, suggesting potential adverse effects on speculative assets like Bitcoin.

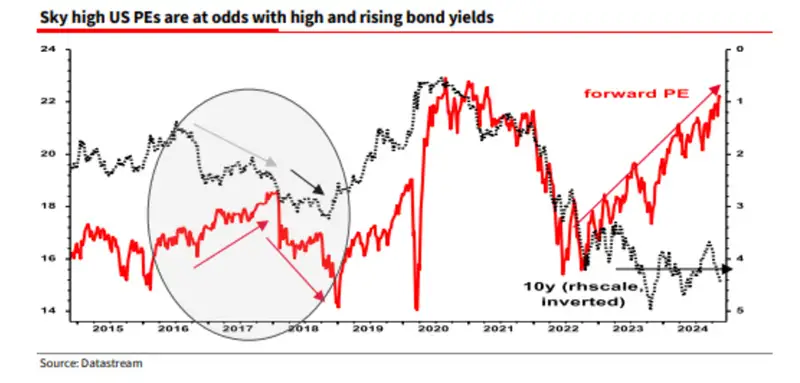

- Impact of Rising Treasury Yields: Edwards warns that increasing yields on 10-year Treasury bonds could siphon investment away from stocks, as these bonds offer risk-free returns. He argues that as valuations remain high, the pressure from rising yields will ultimately weigh on stock prices.

Edwards illustrates his argument by citing historical instances where rising bond yields led to market corrections, such as the euphoria experienced in 2018 and the subsequent downturn in 2022. He compares the current market conditions to an elastic band stretched to its limit, indicating that a significant correction could be imminent.

Despite his bearish stance, it's worth noting that Edwards' recent track record has been less than stellar, as he has maintained a pessimistic view while the market has continued to rise. Nonetheless, he has successfully predicted past market downturns, such as the 2000-2002 bear market, which lends some credence to his current warnings. In the words of Bloomberg Opinion Columnist Marcus Ashworth, Edwards' insights are regarded as essential reading for fund managers, even if his predictions do not always materialize.

Stay ahead of the AI wave

Get started today! Become part of the Qoir community and collaborate with like-minded professionals.

Subscribe to our newsletter today to receive regular updates, exclusive content, and special insights directly. Together, let's explore the limitless possibilities of artificial intelligence and shape the future of technology!

Today's AI News Portal: todaysai.org

Ask Qoir: qoir.com

Qoir AI: qoir.com/home

Stay connected on X: x.com/QoirAI

Join Linkedin Community: linkedin.com/company/QoirAI

Threads: threads.net/Qoir.AI